Smarter investing made simple. Optimize your portfolio like institutions do — without the spreadsheets.

TL;DR: I’m building Alphora, a portfolio intelligence app that gives long-term investors institutional-level analytics: risk-adjusted metrics (Sharpe, Alpha, Beta), diversification diagnostics, an MPT-based optimizer (long-only, fully invested), portfolio-aware news, dividend intelligence, and clean visualizations (including a network view of how your holdings relate). If that sounds useful, join the waitlist →

The problem: trackers show numbers, not decisions

Most portfolio tools do a fine job listing positions and plotting performance. But long-term investors still struggle with the real questions:

- Is my portfolio’s return efficient for the risk I’m taking?

- Where am I unintentionally concentrated; sector, geography, or single-name risk?

- When should I rebalance, and by how much?

- How do dividends actually contribute to my total return and future income?

- Which news actually matters to my portfolio today?

The current market is crowded with trackers, research portals, and all-in-one finance dashboards. Useful, yes — but they’re either content-heavy, execution-first, or analytics-light. Rarely do you get actionable, portfolio-specific analysis that tells you what to do next.

What I’m building with Alphora

Alphora turns portfolio theory into practical guidance. It’s built for long-term, data-savvy investors (and anyone who wants to think like one).

1) Practical Modern Portfolio Theory (MPT)

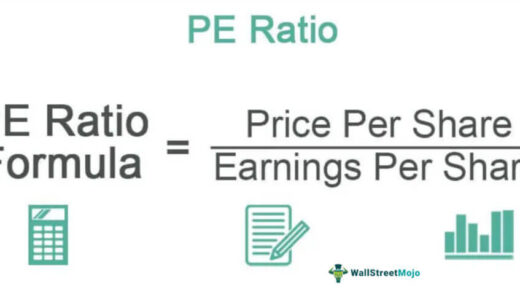

- Risk-adjusted metrics: Sharpe, Sortino, Alpha, Beta, Information Ratio, drawdowns.

- Contribution to risk per holding: see what actually drives your volatility.

- Efficient-frontier optimizer (long-only, fully invested): pick low/medium/high risk, get target weights and drift-based rebalance suggestions.

2) Diversification & factor clarity

- Exposure by sector, region, currency; correlation & covariance between holdings.

- Factor-style hints (growth/value, large/small) to spot hidden tilts.

3) Dividend intelligence

- Dividend history and growth rate, yield on cost, and portfolio-level income view.

- Simple forward income estimates and payout timelines.

4) Portfolio-aware news

- A newsfeed filtered by your actual holdings, with quick sentiment/context.

- Earnings calendar & concise earnings-report summaries for positions you own or watch.

5) Visual insights that explain themselves

- Clean dashboards plus a network graph (nodes = securities; edges = covariance/news relationships) so you can see concentration and contagion risk.

- “Why it matters” tooltips on every metric to keep things beginner-friendly.

How it works (high level)

Under the hood, Alphora ingests pricing, fundamentals, and news via APIs and computes the statistics on the fly:

- Builds a variance–covariance matrix across your holdings.

- Computes risk/return metrics and efficient-frontier points subject to long-only and fully-invested constraints.

- Monitors allocation drift and highlights minimal-change rebalance paths.

- Maps news to your securities and surfaces what matters for your portfolio today.

- Tracks dividend events to show total return and income trajectory clearly.

No spreadsheets. No PhD required. Just credible math, presented clearly.

Who it’s for

- Long-term investors who want to understand risk and diversify intelligently.

- Dividend & retirement investors who care about income reliability and growth.

- Data-curious users who appreciate transparent metrics with plain-English explanations.

(Traders and live options Greeks are on the roadmap, but the core is long-term, fundamentals-plus-risk.)

What makes Alphora different

- Institutional analytics, democratized: Full MPT toolset with explanations.

- Actionable, not generic: Portfolio-aware news, earnings, and rebalance guidance.

- Clarity by design: Visualizations that teach as they inform (risk contribution, network graph, scenario nudges).

- Dividend-first view of total return: See how income actually drives your results.

Roadmap (building in public)

- AI Screener: Personalized ideas to reduce concentration and improve diversification.

- Portfolio forecasting: Forward views that account for dividends, volatility, and drift.

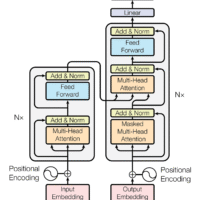

- Time-series modeling: Research phase on transformer-style models for price/income scenarios (positioned as foresight, not fortune-telling).

- Broker integrations & timelines: Clean transaction history (buys/sells/dividends) and simple import.

If you want early access, feedback privileges, and a say in what ships first, hop on the list.

Join the waitlist

I’m building Alphora to give individual investors the same analytical edge institutions take for granted; minus the complexity. If that resonates:

👉 Join the waitlist at alphora.com

No spam. Unsubscribe anytime. And of course: nothing here is investment advice.